eco Sessions at the WHD.global provided international visitors with insight into surviving in a tough market

Rust, 16 March 2016 – What should you NOT do when you try to do business with Germans? With a little bit of self-deprecating humor, Dr. Rolf Claessen from FREISCHEM Patentanwälte kicked off the eco Sessions at the WHD.global on Doing Business in Germany on 16 March. The stage was filled to maximum with a 7-member panel of CEOs, company owners and consultants talking about their experiences with inter-cultural communication.

The panel – made up of Dr. Béla Waldhauser, Telehouse Deutschland GmbH, Michael Frey, FACT-Encryption, Vincenz Wagner, Enterprise Ireland, Werner Paulus, wepacom.com, Staffan Reveman, Reveman Energy Academy, and Johannes Schäfer, Frankfurt Economic Development GmbH – gave their insightful and often entertaining answers:

- DON’T use first names, DON’T be late to meetings, DON’T be offended by straight answers and a lack of beating-around-the-bush politeness formulations.

- DO do your homework, DO get your facts and figures right. Expect to be challenged on any fuzziness or grand claims.

- DON’T expect things to happen quickly. Expect lead-times of 18 months to two years, have after-sales service in the German language, and demonstrate that you’re a reliable long-term partner.

As Vincenz Wagner so delightfully illustrated, one can think of the German customer as an elderly spinster – frightened of yet more disappointment, very careful about who gets close. She wants to know you’re still going to be there five years from now, and that you can and will deliver on your promises.

This made an enjoyable start to eco’s DBI Germany morning in Rust at WHD.global. The panel was followed by an overview of the relevant laws for international companies trying to break in to the German market. In the session “Dealing with the Law”, Dr. Thorsten Hennrich from BMT Legal Partners provided a brief introduction to contract law, data protection law, employment law, competition law and corporate law, and Dr. Rolf Claessen reappeared onstage to talk about Intellectual Property, patenting and trademarking within the German context.

The speakers brought up a range of issues to bear in mind, including:

- Watch out when you employ staff – it’s much harder to fire workers under German employment law.

- Make use of standard German contracts, because “surprising” terms or unreasonable clauses may invalidate the contract.

- Be aware of special obligations for e-commerce platforms.

- Check that your business name is not already in use or has a history in your sector.

- Find out if there are existing German patents (as opposed to international ones) that your product might be infringing.

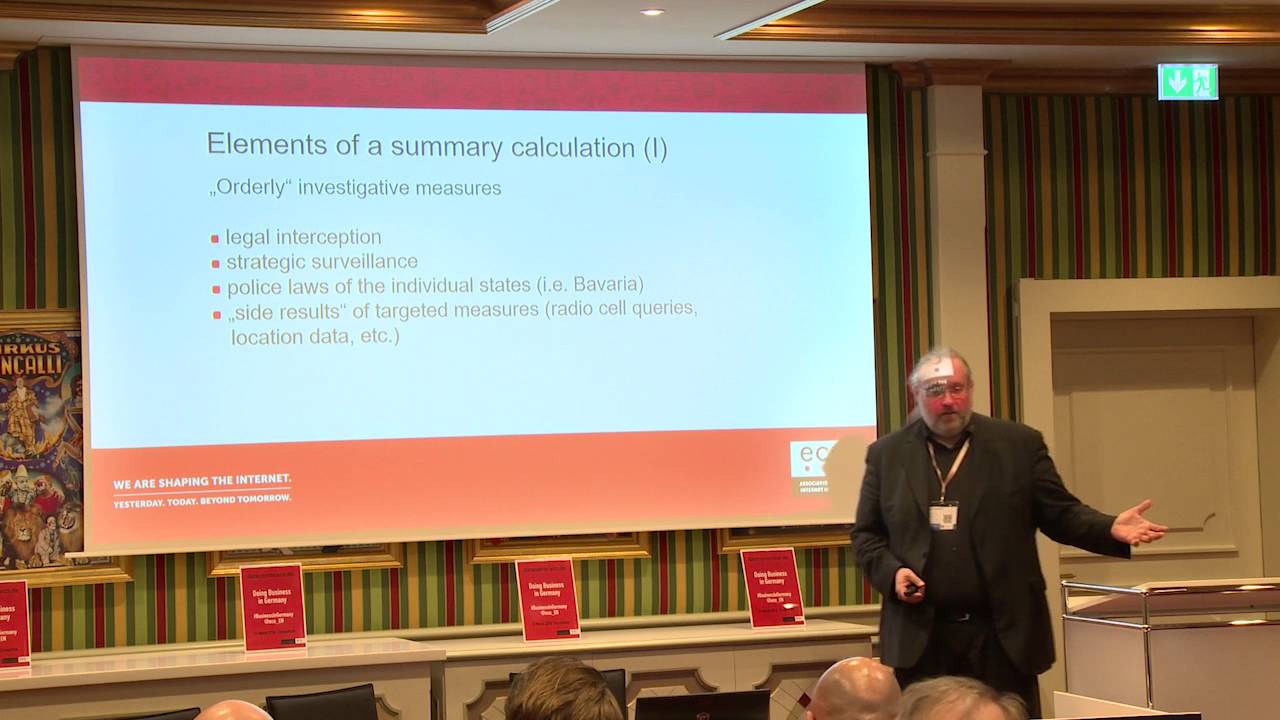

Following this, eco Board Member Klaus Landefeld gave an overview of German constitutional law regarding surveillance of Internet and telecommunications data, and discussed the unexpected increase in surveillance activities since the Snowden revelations. He advocates for what is known in German as an “Überwachungsgesamtrechnung” – a clarification and summary of all the surveillance activities of different agencies, to ensure that an unconstitutional “total surveillance” is not occurring.

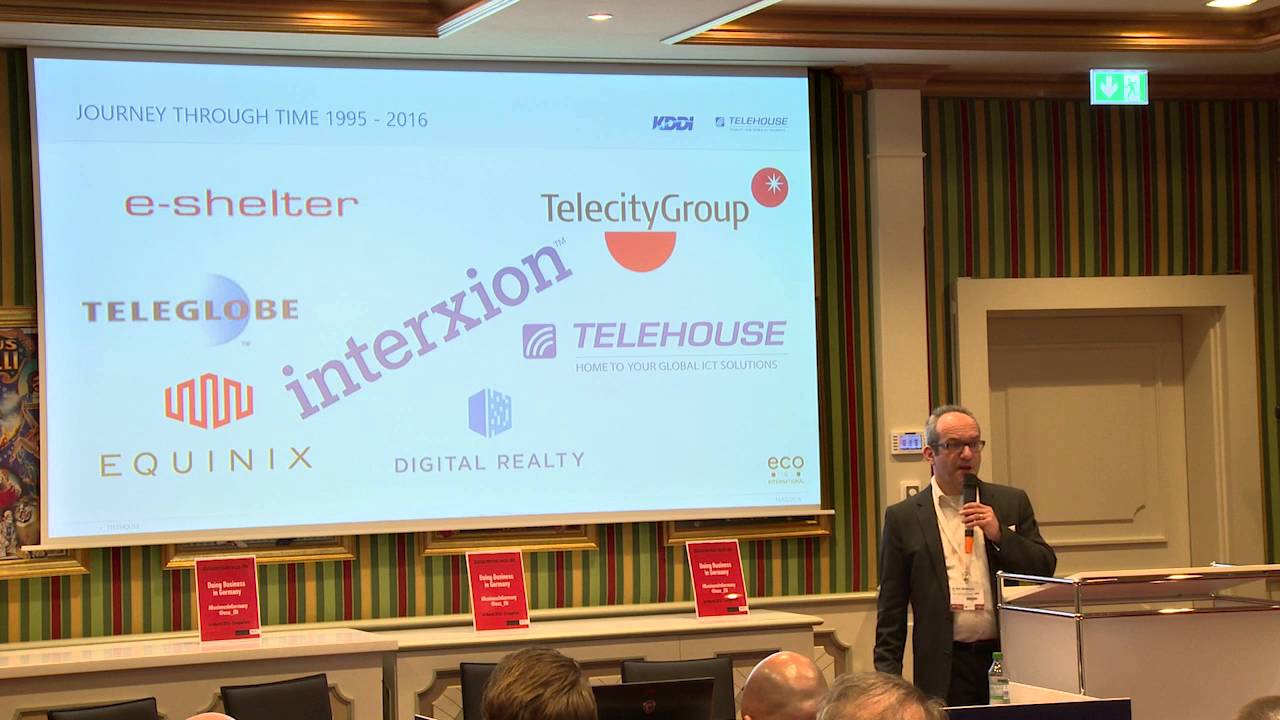

Dr. Béla Waldhauser then returned to the stage to give “A Journey Through Time: 1995–2016” – a whirlwind tour through the development of the data center market in Germany and around the world over the last two decades.

He then brought the panel members Frank J. Zachmann from Digital Hub FrankfurtRheinMain e.V., Julian King from Zenium Germany GmbH, Marco Houwen from LU-CIX asbl., and Dr. Thomas Fischer from noris network AG to the podium to discuss “Market Consolidation: The German Data Center Market”.

The panel speakers all agreed with Dr. Waldhauser’s prognosis that we currently find ourselves in what he considers to be the third wave of consolidation in the data center market – a wave driven by the jostling for the position of top dog, with M&A activities based on strategic expansion.

However, the speakers do not see this development as a one-way process. There has been an influx of new players coming into the European, and specifically the German market in recent years. Since the Snowden NSA revelations and the Safe Harbor upheaval, a number of the large global players have found the need to invest in territory in Germany.

But it’s not just the big ones: players of various sizes – for example, Zenium – are being drawn in by the gravity of the Frankfurt hub, the most important data center address in Germany and one of the most important in Europe. That said, the panel members expect a further wave of consolidation in the next few years, as these new players also jostle for space in the market.

Away from Frankfurt, other panel members also had their say. Luxembourg, with the highest concentration of Tier IV data centers in Europe but a very small local market, is looking to international customers – including German – to expand their market. On the other hand, noris network AG take the reverse approach, with a deliberately regional focus, away from Frankfurt.

Noris network is in the process of building a new data center in Munich, and there is a growing trend towards regional data centers in Germany – although this is not expected to impact the fundamental importance of Frankfurt.

The morning of sessions was rounded off by Lars Riegel’s introduction of the English translation of the eco and Arthur D. Little study of the German Internet industry, with forecasts of strong growth well above other industry sectors through to the year 2019.

In particular, he focused on the hosting industry which, as a result of saturation, is only growing at a rate of 4 percent CAGR per annum, in contrast with 12 percent for the industry overall. He provided case studies to illustrate four possibilities for generating growth in the hosting sector, those being

- Effectiveness – providing an excellent existing service in an existing segment

- Widening the product portfolio to provide new services in the existing segment

- Expanding globally – rolling out the existing service in new segments

- Non-core growth – expanding into new segments with new services

Dr. T. Hennrich: Dealing with German Law

Klaus Landefeld: Surveillance in a digital society

Dr. Béla Waldhauser: Market Consolidation

Lars Riegel: Internet Industry Germany & Growth Opportunities

Photos of the WHD.global sessions can be found in our flickr album.

Interview with: Interview with:Dr. Rolf Claessen |

Interview with: Interview with:Vincenz Wagner |

Interview with: Interview with:Dr. Béla Waldhauser |

The eco and Arthur D. Little study

“The German Internet Industry 2016-2019”

can be downloaded free of change.