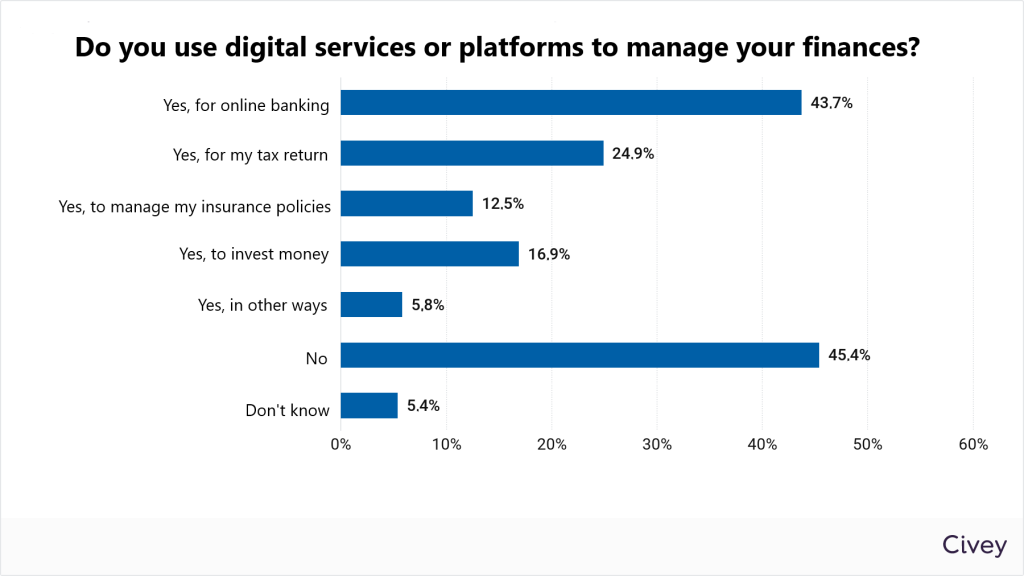

- Online banking is most popular at 43.7%

- 24.9% file their tax returns online

- Only 45.4% do not use digital financial management services at all

- eco Association gives 7 tips for secure online financial management

Approximately one in two Germans (49.2%) use digital services or platforms to manage their own finances. This is the result of a recent representative survey conducted by the market and opinion research institute Civey on behalf of the eco – Association of the Internet Industry. For example, 43.7% of people do their banking online. 24.9% file their tax returns digitally on their computer or smartphone. Investing money via smartphone app or browser is popular with 16.9% and 12.5% of Germans manage their insurance online. Almost one in two (45.4%) still do not manage their finances digitally at all.

“Managing online finances is a matter of course for a growing proportion of the population,” says Head of the eco Competence Group Olaf Pursche. “The high popularity of online banking shows that many people trust online financial service providers to securely handle their data and money. The successful digitalisation of the financial sector and the high level of customer acceptance is exemplary for other sectors, particularly the urgently needed digitalisation of administration.”

However, it is not only financial service providers that have to meet the highest security requirements. Individuals can also do a lot to protect their own devices and digital identities, i.e. their own credentials, and not give cybercriminals a chance:

- Do not open suspicious emails, attachments or links from strangers. Cybercriminals look for vulnerabilities to install malware or ransomware (blackmail Trojans) via phishing emails. The emails that cybercriminals use to try to get your credentials for online financial applications are getting better and often look deceptively genuine. Never click on links in emails that take you to login pages. Instead, go directly to your provider’s smartphone app or website and enter your login details yourself.

- Always use two-factor authentication offered. Many people are happy to enter their username and password or use biometric authentication on their mobile phone, such as fingerprint or facial recognition. But especially when it comes to your own money, a second factor should be used: For example, an access code via SMS, a TAN number from the generator or confirmation in a separate app.

- Only trust financial apps from official stores, such as Google Play or the Apple App Store. Do not follow links that take you to other app download portals. Search for apps directly in the official app stores. You should disable the installation of apps from unknown sources in the settings.

- Do not make financial transactions over unknown WiFi. Avoid open or unsecured WiFi in public places such as cafes, restaurants or beer gardens. If in doubt, use the cellular network instead. Or use a VPN (Virtual Private Network), which securely transmits data to your financial service provider through an encrypted virtual tunnel.

- Be sure to set up password protection on your laptop and screen lock on your tablet and mobile phone to prevent unauthorised access. Use strong, cryptic passwords or biometrics such as fingerprints or facial recognition.

- Don’t give malware such as blackmail Trojans (ransomware) a chance. Use antivirus software and regularly scan your smartphones, laptops and tablets with an up-to-date antivirus programme. Set your smartphone to notify you of updates or install them automatically.

- Set up the option to remotely locate and lock your mobile phone or tablet to prevent access to your user data. To do this, go to android.com/find on Android or sign in to iCloud.com/find on iOS. You can then locate it and report it as lost.

Download photo of Olaf Pursche